CEO message

“The sheer purpose of this platform is to inculcate financial knowledge in everyone among the masses, from a common man to a professional, from a housewife to a scientist, from a student to an expert. Whether you have a background of finance or not, you can’t escape from finance.

Besides the capability enhancement of students, professionals, and researchers through this platform, I have a vision to minimize financial crimes through financial literacy”

-DR.Tooba Khalid

CEO, Finlance Global

CEO/FOUNDER

With 12-years of post-qualification expertise in the finance sector, Dr. Tooba is a consultant, Trainer and a Researcher who adeptly navigated diverse realms of finance mainly including financial modeling, financial markets, financial crimes, surveillance, investigations, and AML/CFT regulatory compliance. She brings a wealth of experience bolstered by comprehensive training and professional certifications from national and international forums in combating financial crimes besides her doctorate from Universiti Teknologi Malaysia. Her track record speaks to a dedication to ongoing learning, underscored by engagement with international organizations, ensuring a broad global perspective. Currently, fueled by an entrepreneurial drive named “Finlance Global”, a passion for enhancing financial literacy to minimize financial scams and frauds, especially for women.

Her detailed profile can be observed at https://www.linkedin.com/in/toobaakram/

Dr. Tooba Akram

Founder/ CEO

Our Vision

Our vision is to be the catalyst for a financially empowered world. We aspire to create a global community of individuals who possess not only a profound understanding of financial principles but also the ability to apply this knowledge effectively in their personal and professional lives. Through our innovative training and workshops, we aim to demystify complex financial concepts, making them accessible to students, professionals, and researchers alike. By fostering a culture of continuous learning, critical thinking, and ethical decision-making, we envision a future where financial literacy is not just a skill, but a fundamental tool that empowers individuals to make informed choices, seize opportunities, and navigate the dynamic landscape of finance with confidence. Together, we are shaping a world where financial knowledge transcends barriers and paves the way for financial success and security for all.

Scope

Education and Training Programs

The company can offer a wide range of education and training programs, catering to students, professionals, and researchers at different levels of expertise. These programs could cover topics such as personal finance, investment strategies, financial analysis, risk management, and more

Customized Workshops

Tailored workshops can be designed to address specific needs of different target groups. For instance, workshops for beginners might focus on basic financial literacy, while advanced workshops could delve into intricate financial concepts for researchers and professionals.

Online and In-person Learning

The company can provide flexibility by offering both online and in-person learning options. This allows participants from different geographic locations to access training materials and engage in interactive sessions according to their preferences

Content Development

Developing comprehensive educational content, including video lectures, articles, case studies, and interactive simulations, can extend the company’s impact beyond workshops and training sessions.

Research and Publications

The company can contribute to the financial knowledge landscape by conducting research, publishing articles, and sharing insights on emerging trends and best practices.

Certifications and Credentials

Offering certifications or credentials upon completion of programs can validate participants’ acquired skills, making them more appealing to potential employers or enhancing their credibility as researchers.

Support for Entrepreneurs

Entrepreneurial individuals can benefit from understanding financial concepts to effectively manage their businesses’ finances, make strategic decisions, and attract investments.

Continuous Learning

Establishing a platform for ongoing learning and knowledge-sharing, such as webinars, seminars, and networking events, can help participants stay updated with the latest developments in the financial world.

Ethics and Responsible Finance

Integrating discussions on ethical considerations, responsible investing, and sustainable finance can align with current societal trends and expectations.

Global Reach

Integrating discussions on ethical considerations, responsible investing, and sustainable finance can align with current societal trends and expectations.

Career Advancement

The company’s programs can equip participants with skills that enhance their career prospects in finance-related fields. This can include roles in banking, investment management, financial analysis, consulting, and academia.

Partnerships with Institutions

Collaborating with educational institutions, corporations, and research organizations can broaden the company’s reach. These partnerships can lead to integrating financial literacy programs into academic curricula, corporate training initiatives, and research projects.

TRAINERS

Dr. Tooba Akram

CEO |Trainer | Financial Analyst| Financial Crimes and Compliance Expert

Prof Dr. Muhammad Naveed

Principal/Dean (Business school) | Researcher | Corporate and Academic Financial Advisor | Accreditation Expert

Dr. Syed Ahmed Gillani

RESEARCH EXPERT | DATA ANALYSIS EXPERT | CORPORATE TRAINER | ASSISTANT PROFESSOR (GC)

Anam Khan

Finance Professional | White Collar Crime Investigation Expert | xSEC | CCP

Dr. Hammad Raza

FINANCIAL DATA EXPERT | RESEARCHER | CORPORATE TRAINER | ASSISTANT PROFESSOR (GC)

Dr. Adnan ali

Finance Expert | Researcher | Trainer| Head of Dept (SSBBU)

Muhammad Shoaib Akram

FCCA| UAE (CA) | Financial Analyst| Compliance Expert

Prof Dr. Mushtaq Ahmed

Vice Chancellor | Academic Expert | Stanford (UK) | Dean & Director, MIU Narian Sharif AJK

SHAZIA PeRVEEN

A Commercial and SME banker | Credit Risk Analyst | Financial Inclusion Specialist | Prudent Banking Practitioner specific areas of TBML, AML, FATF

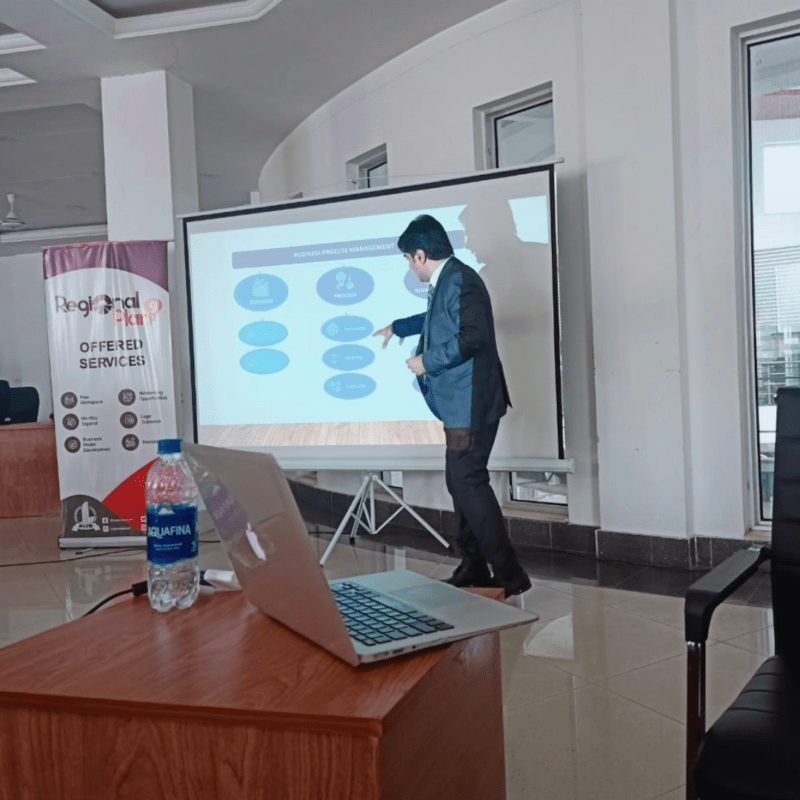

UPCOMING EVENTS / PAST EVENTS

GALLERY

Clients and Colloborators

Contact US

Get in touch

info@finlanceglobal.com

+92 327 5887780

Payment Details:

Account Title: Finlance Global Education (SMC-Private) Limited

Bank Name: Askari Bank Limited

Bank Swift Code: ASCM PKKA

A/c Number: 7053570002013

Branch Code: 705

IBAN#: PK43ASCM0007053570002013

Branch: 38-Zahoor Plaza Jinnah Avenue Blue Area Islamabad Pakistan